Your Flex Debit Mastercard®

Our Flex Debit Mastercard® is still a debit card at its core, but with the added convenience and security of Mastercard®, allowing for more flexibility in the way you use your debit card.

Our Flex Debit Mastercard® is still a debit card at its core, but with the added convenience and security of Mastercard®, allowing for more flexibility in the way you use your debit card.

Easily checkout online or set up recurring payments with your new card at participating Canadian1 and international merchants, all while using the funds you have in your Motor City account.

When making purchases online or using your card internationally, the funds come directly from your available balance in your Motor City account at the time of purchase. No need to worry about monthly credit card payments or interest rates.

Your card is now a Debit Mastercard, or as we like to call it, the Flex Debit Mastercard, a card that allows you to do more. It can be used to make purchases online1, in-store locally, and wherever Mastercard is accepted, internationally. Which means you can use Debit Mastercard anywhere you would use Mastercard while travelling. Any purchases made with your new Debit Mastercard are paid directly from your personal chequing or savings account just like your previous debit card.

No, the Flex Debit Mastercard is a Debit card that can be used where Mastercard is accepted (online1 and internationally). Any purchases made with the Debit Mastercard are paid with funds you have in your personal account. Therefore, you must always ensure you have sufficient funds in your account when making purchases.

No, all previous cards will be replaced with a Debit Mastercard.

All members have access to the Debit Mastercard no matter their age. However, members under the age of 16 must have a parent or guardian’s consent. Youth ages 16 or older do not need to have consent from a parent or guardian.

It’s a Debit card. Your new card has both logos to highlight that you can make purchases using both payment networks. Purchases made in-store in Canada are Debit transactions processed by Interac, whereas online and international transactions are processed by Mastercard. This works similarly for ATM transactions where in Canada your card utilizes the Interac or Exchange Network, and internationally it utilizes the Mastercard network.

While the Debit Mastercard is a very reliable card anywhere in the world, there still may be circumstances where your card may have trouble if the issue is on the merchant’s end, but if the Mastercard logo (or any other logo on the front or back of the card) is present, the card has the capability of working at that machine. There are also some Canadian online merchants that do not currently accept Debit Mastercard as they need to be signed up for this. A list of participating online Canadian retailers can be found here.

Cards are processed as quickly as possible and then delivered by our delivery partners. If your card has not arrived within the time frame communicated to you please contact us. For security purposes, we recommend destroying your existing debit card and removing it from your mobile wallet immediately upon fully activation your new card.

Yes, when you receive your Debit Mastercard, you’ll have to activate it by making a transaction using your chip and PIN number at a store in person or at a credit union ATM, find one by clicking here.

This is a security feature; before making online purchases, you’ll have to activate your card by completing a chip and PIN transaction in-store at a point-of-sale terminal, at a credit union ATM, or at a Motor City branch.

Yes, the same limits that applied to your previous debit card for point-of-sale transactions also apply to your new Debit Mastercard. If you’re unsure of what your limits are, please contact us and we can share them with you.

The same transaction fees that applied to your debit card also apply to your new Debit Mastercard, including withdrawals from a non-credit union ATM and international ATM transactions. For more information on transaction fees, click here. Additionally, international ATMs will have currency exchange fees and possibly other fees. Motor City charges a 2.5% foreign transaction currency fee for any international transactions, this fee is in line with what most Canadian Financial Institutions charge for similar transactions. “Dynamic Currency Conversion” options at ATMs and point-of-sale terminals can also increase service fees and exchange markups that go directly to the merchants and are not collected by Motor City. You may want to avoid this option by declining it if presented and choose to transact in the local currency.

ATM and point-of-sale transactions done within Canada continue to work like a traditional debit card running on networks like Interac® and The Exchange Network®. Any online (e-commerce) purchases made at participating Canadian retailers will utilize the Mastercard® network, but still only use the funds available in your Motor City account. Any international online, point-of-sale, or ATM transactions will also utilize the Mastercard® network and again, still only use the funds available in your Motor City account. Check the back of your card for ATM and point-of-sale networks that are supported when you are out of the country or utilize these ATM listings below.

Many hotels will accept Debit cards as payment including Debit Mastercard, while others will not. And some hotels accept payment both ways, i.e., Debit and credit cards. Whether or not a hotel will accept Debit as payment varies from place to place as the policies around which cards are accepted are set by the hotel/merchant (not Motor City). It's always best to call ahead and ask before you make your reservation. They may also accept Debit Mastercard for online booking but not in-person transactions, again this varies from hotel to hotel so please contact them to learn more.

Please note that when making reservations the merchant may put a hold on the funds to guarantee your reservation and you must have enough in your account to cover the value of the hold. If you're unsure what the value of the hold is, you can ask the hotel/merchant to clarify, or your online banking will show you if there are any current holds on your account.

It depends, if you are in Canada always select “debit” as your card works as a debit card domestically.

If you are outside of Canada, your card acts as a Mastercard using their payment network, so select “Credit” or “Mastercard.”

If you choose the wrong one, the transaction will decline and you can ask to re-try the transaction and then select the other option.

Currently, some Canadian online merchants don’t yet accept the Mastercard Debit for online transactions, but your card can be used with any international retailer that allows for Mastercard transactions. A list of participating online Canadian retailers can be found here and this list is updated whenever a new merchant joins. Please note that if you attempt to use your card on a site that doesn’t accept Debit Mastercard your transaction will be declined.

If a Canadian merchant you are transacting with does not currently accept Debit Mastercard® as an online payment option, the most effective way to get them to look into this is by you, the customer, reaching out to these merchants directly to request adding Debit Mastercard® as a payment option.

Yes, your new Debit Mastercard will be set up to complete tap payments by default.

Yes, you can add your Debit Mastercard to your mobile wallet on all supporting devices (Apple Pay, Google Pay, and Samsung Pay). If you’ve had your new card for less than 30 days, you’ll need to call us to complete the process. This is done to provide extra security and protect your card against fraud. If you are adding a new card to replace a previous card, please remember to delete your old card.

Return transactions for items bought online may take up to seven days to be credited to your account. The speed of your return depends on how quickly the store you purchased the item from processes it in their system.

When withdrawing money from an ATM outside of Canada, it won’t ask you to select an account (chequing vs. savings) and will default to your chequing account. If you don’t have sufficient funds in that account, the transaction will be declined.

“Dynamic Currency Conversion” options at ATMs and point-of-sale terminals can also increase service fees and exchange markups that go directly to the merchants and are not collected by Motor City. You may want to avoid this option by declining it if presented and choose to transact in the local currency.

Your Debit Mastercard was designed with your safety in mind! There are quite a few fraud features and details you can learn about:

Tip: if your mobile phone number or email has recently changed, please contact us to ensure your information is up to date, or update it in online banking or the mobile app to ensure you are receiving notifications to the correct number or email.

Misplaced your card or want some extra security? Within online banking or the mobile app, you can easily lock your Flex Debit Mastercard® from any transactions being processed. You can also block certain types of transactions (like international transactions) to help prevent fraud. Simply navigate to Lock’N’Block under “Account Services” in online banking, or locate the Lock’N’Block icon in the mobile app. Our Member Assistance Team can also enable or disable these options for you.

Please ensure you contact us if your card has been stolen or compromised.

[Access Lock’N’Block In Online Banking] button to: https://online.mcccu.com/OnlineBanking/AccountServices/LockNBlock/

You can change your PIN at any Credit Union ATM in Canada that supports PIN changes in case you want to update your PIN for peace of mind or you believe your PIN may have been compromised.

Your card has Interac® Zero Liability and Mastercard® Zero Liability built in so you can pay with confidence.

Interac® Flash Security Features

Learn more about Interac Flash Security

Visit online banking or the mobile app to Lock‘N’Block your card as soon as possible if you have transactions you didn’t authorize or if your card has been stolen. Then, report your card as lost or stolen by contacting us during business hours, or for after-hours support contact 1-888-277-1043.

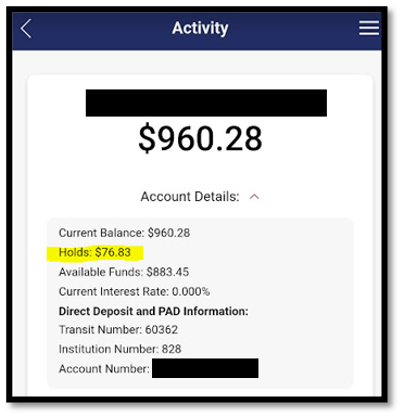

When you make an online, pre-authorized or international purchase with your Debit Mastercard a temporary hold in the amount of your transaction (or slightly higher) is placed on your account which is reflected in your account’s “Available Balance” amount. The transaction will not be visible in your online banking under detail history or taken off your account balance until it’s posted, which will usually happen within 24-48 hours, but will vary significantly by merchant. Your available balance is the funds you have access to. Tip: Hold amounts on your account and your available balance is always viewable in the “Account Details” drop-down of your account in online banking and mobile app, as mentioned in answer 3 below.

It’s possible a hold for a larger dollar value than the actual purchase has been placed on your account. An example of when this might occur is when you’re paying at a gas pump and select “fill” instead of a specific dollar amount. A hold is placed on your account for the larger pre-authorized amount however you will only be charged the amount it took to fill your gas tank.

The example below shows a hold for an online purchase of the same amount. The “Available Balance” is the “Current Balance” minus the “Holds”.

Some vendors take longer to process payments than others, so you may see some transactions posted to your account quicker than others, even if they were performed on the same day.

With the need for holds on transactions until they are processed, your transactions will show the date the transaction was processed to your account as the date of the transaction, not the day the transaction was initiated and the hold placed.

If you cancel a transaction/order shortly after a purchase (for example: an Amazon order), a hold may remain on the account and may not be removed by the vendor as they did not have time to process the payment after the initial hold.

Be sure to update any online accounts that have your old card number stored (i.e. subscriptions, pre-authorized payments, websites, etc.). Please also remove your old card from your mobile wallet before adding your new card. When you receive your replacement card, you’ll have to activate it by making a transaction using your chip and PIN number at a store or a credit union ATM.

To order a new Debit Mastercard, contact us. If you need a new card on the same day, you can get a replacement by visiting your local branch, however this card will not have your same card number and will not have your name on it.

Please note that if you have your Debit Mastercard reissued in the branch and request to receive another customized with your name on it in the mail, you will incur a card replacement fee. This also applies if you habitually lose your card and require more than one replacement. You can see a full list of transaction fees here.

If you have a dispute about an online purchase and haven’t been able to resolve it with the store/vendor, you may contact us. We must know of the dispute within 90 days of the date of purchase and the expected date of delivery. Disputes may take 8-12 weeks (about three months) to resolve.

Please note that if you made a purchase and the store has not provided you with the goods or services or the goods/services are not as described, we may be able to assist you. However, we will not be able to assist you in disputes about the quality or suitability of the purchase, nor can we help with any PIN transactions.

If you receive reimbursement from the store no further action can be taken by Motor City to claim a refund.

1 It’s accepted online at any international online store that accepts Mastercard and participating online stores within Canada. For a list of Canadian stores, click here.

®Mastercard is a registered trademark, used under license.

®Interac and Interac Flash are registered trademarks of Interac Inc., used under license.

®Lock‘N’Block is a registered trademark of Everlink Payment Services Inc.

While the Flex Debit Mastercard® only uses available funds in your Motor City accounts, any transaction processed through the Mastercard® network (online and international purchase) will act similarly to a traditional credit card transaction. This is done by utilizing account holds on your account’s available balance to approve a transaction before they are fully processed by Mastercard®.

As a result, you may see some of the following scenarios when transacting or in your account history:

The actual transaction showing in your account history and being posted against your account can take up to a few days while being processed by Mastercard®, therefore it will not appear immediately in your account history after the initial transaction like a traditional point-of-sale or ATM transaction. Once the transaction is posted to your Motor City account, the initial hold amount will be removed.

Tip: Hold amounts on your account and your available balance are always viewable in the “Account Details” drop-down of your account in online banking and mobile app.

We have invested in extra fraud monitoring services and tools that will enhance your protection. With features like 2 Factor Authentication on transactions and Lock’N’Block for member-controlled transaction locking and card blocking, we are working hard to protect you. Learn more details about these fraud features in the “Fraud” section of our Debit MasterCard® FAQs.

Debit Mastercard® is available to any member and is a great money management tool for youth to help develop good spending habits by only accessing funds available in their account. Additionally, there is the added convenience of being able to use it for online transactions without the risk of credit.

If a member requesting a card is under the age of 16, parental consent is required to obtain a card.

Transaction Limits for both point-of-sale and online transactions can be lowered at the parent’s discretion by contacting our Member Assistance Team or visiting your branch.

Terms & Conditions

®Mastercard is a registered trademark, used under license.

®Interac and Interac Flash are registered trademarks of Interac Inc., used under license.

®Lock‘N’Block is a registered trademark of Everlink Payment Services Inc.