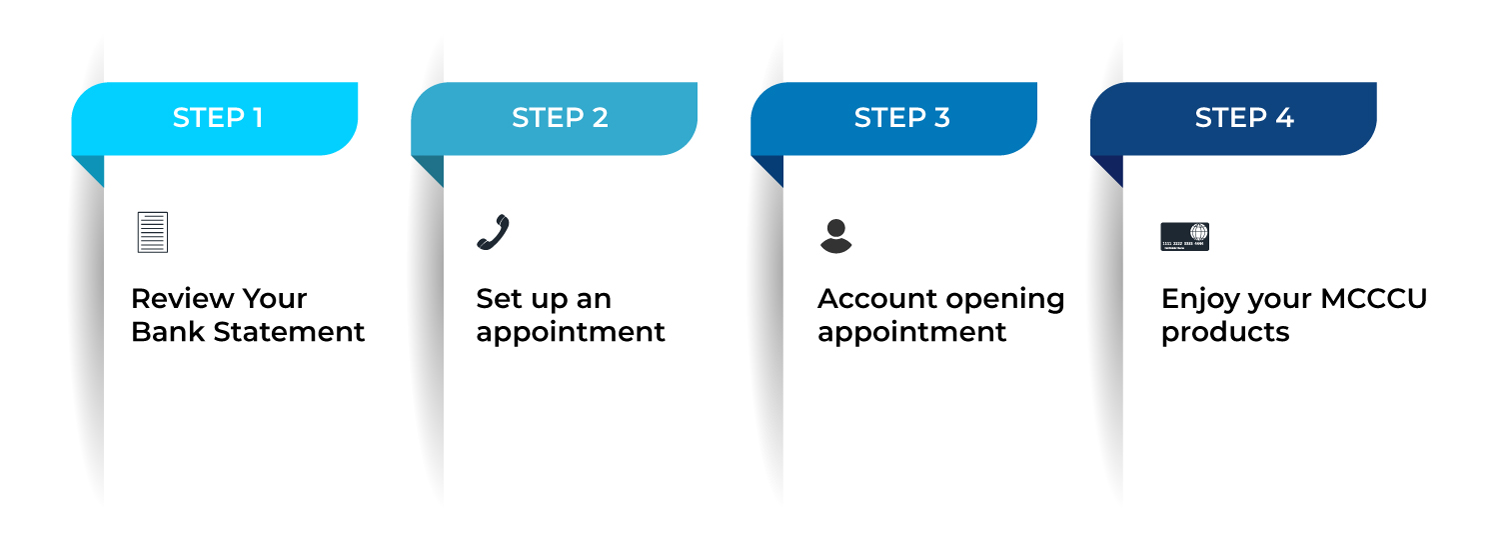

At your account opening, a Motor City representative will guide you through the process of moving over to Motor City and give you some insight into what Motor City is all about.

From there, they will set you up with your new account(s) and may utilize our online switching service to help you move your pre-authorized deposits and withdrawals and direct deposits over to Motor City.

Please Note: There will be a transition period that you will need to keep your old accounts open to ensure no pre-authorized withdrawals or deposits are missed as some vendors and companies may take a few weeks to update your banking account information on their end.

With your new account(s) open, we will go over your options for transferring your funds into your new account(s) from your existing financial institution and set you up with other services like online banking and a debit card.

We will then review any other products you have like mortgages, loans, GICs, and other investment that require a little more work on our end to move. We'll develop a plan together to gradually move those products over to avoid penalties and fees associated with closing or moving those products.